How Many Employee Experience Copilots should an Enterprise have?

Hello, and welcome back to my Blog! This is a question that I get all

Hello, and welcome back to my Blog!

Executive Summary

The US market is showing resilience and added 517,000 jobs despite the continuous rounds of layoffs that led to almost 78,000 tech skilled employees losing their jobs in January, according to Layoffs.fyi. Furthermore, the unemployment rate dropped to 3.4%, the lowest since 1969.

Volatile market conditions are creating the opportunity for other industries of hiring high-skilled workers to accelerate growth and profitability. Emerging technologies are disrupting the business landscape and the HR function is discussing how to leverage new technologies to increase productivity, reduce cost and enable workplace collaboration and hybrid work.

The HR function is also exploring new ways to innovate HR capabilities to support areas of growth of the business and leverage the power of talent, technology, and data to identify, develop and mobilize hidden talent to increase operational excellence and drive efficiencies. This means:

Innovation is in full steam in HR technology (more than +11B of investments in 2022). However, 2023 is all about reimaging your Digital HR strategy and technology architecture to facilitate business transformation and redeploy talent into growth areas of the business.

ChatGPT is taking the world by storm. Last week OpenAI lunched chatGPT plus at $20 per month (only available to US companies for now) There is even a waiting list to test and use this AI-enabled application. Furthermore, Microsoft launched Microsoft Teams Premium bringing the latest technologies (including OpenAI’s GPT-3.5).

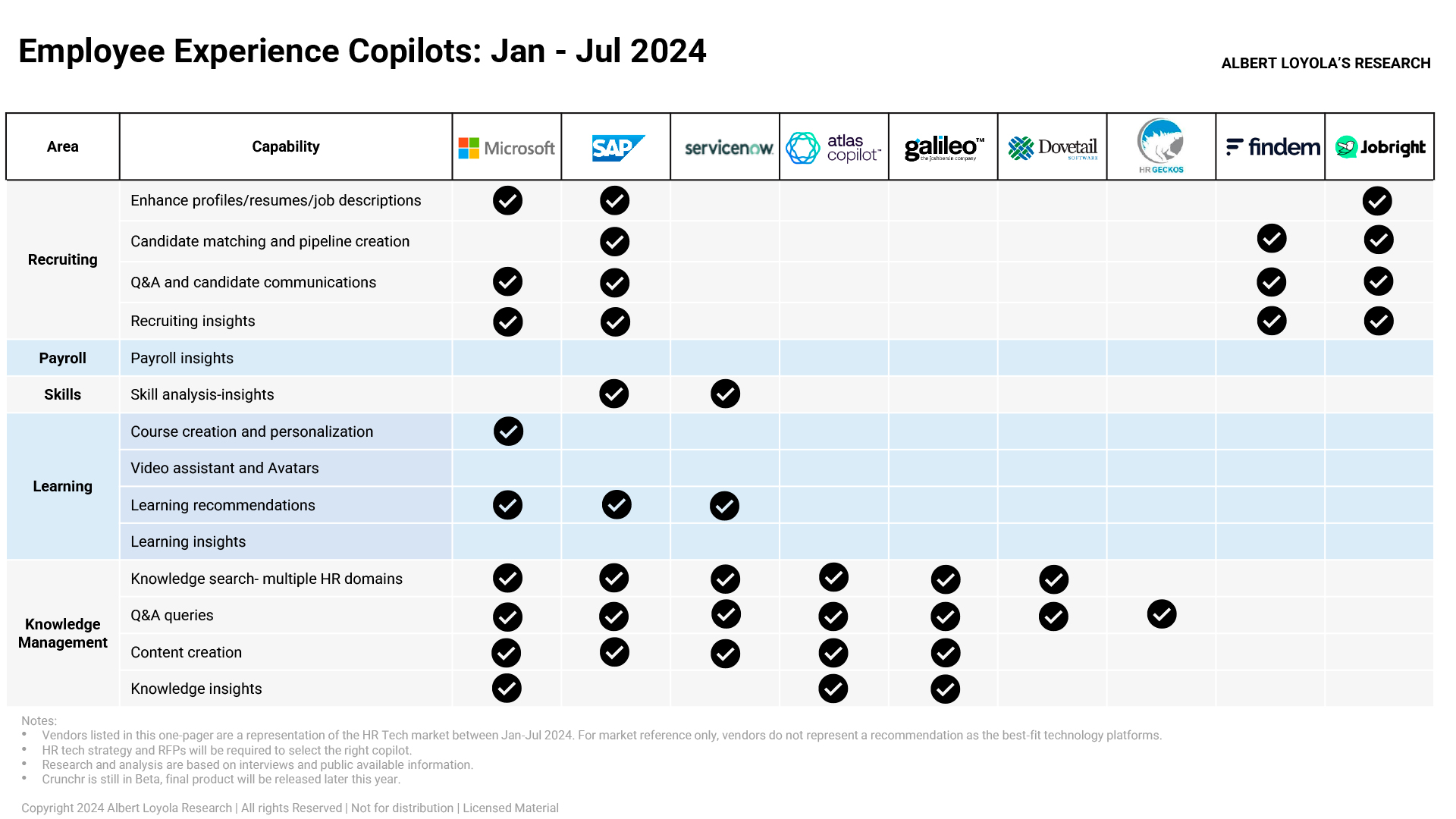

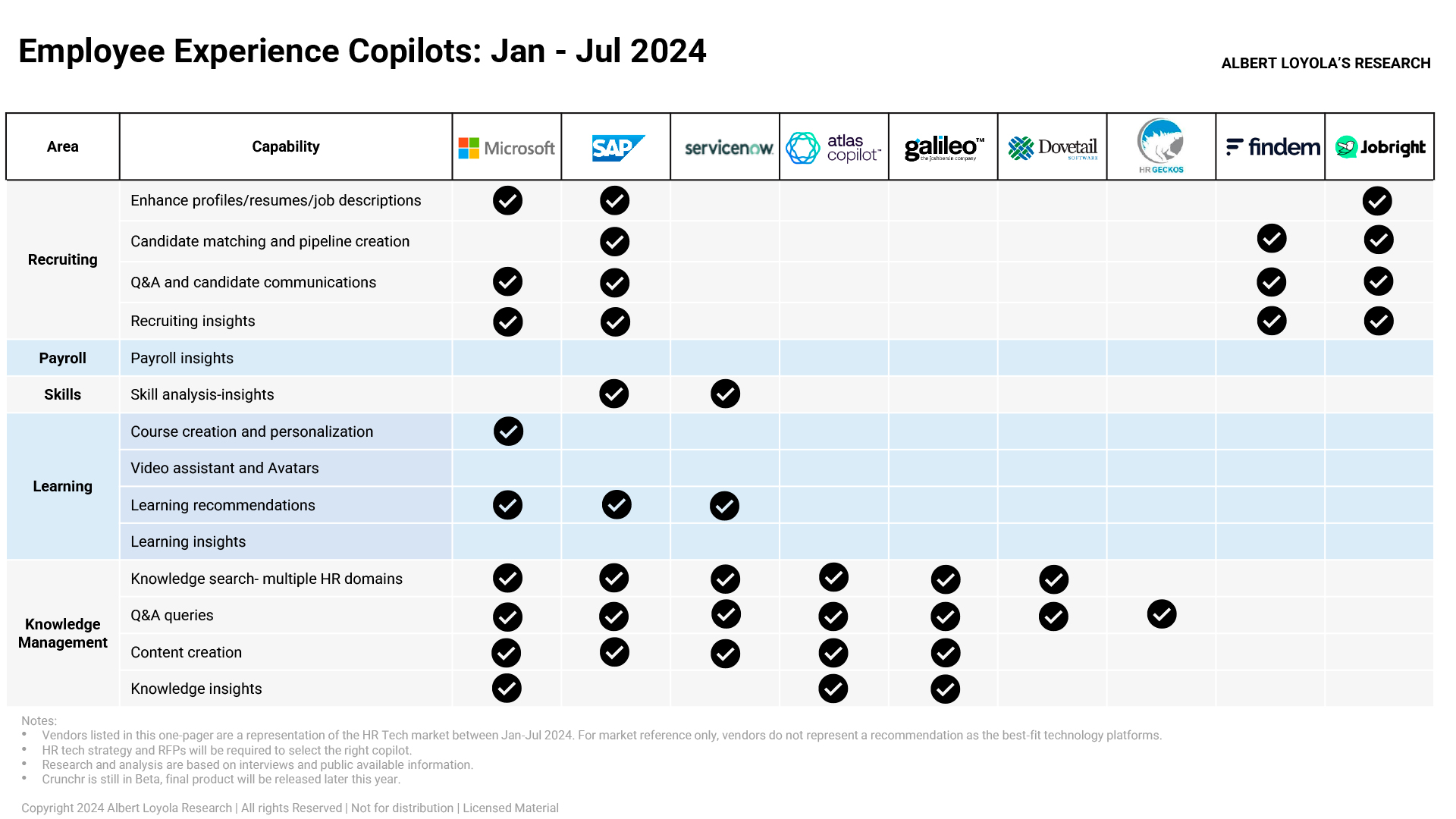

As ChatGPT gets deployed and its algorithms learned overtime, there are multiple HR use cases that this tech can solve for in the future of work space:

HR Technology Ecosystem

We had a very slow start this 2023, with minimum activity in acquisitions and venture capital investment. WilsonHCG acquired Personify (RPO), Clovers acquired Talvista (DEI platform) and My interview raised $11 million in series A funding.

HR technology vendors need use their cash strategically for go to market purposes, re-assess its value proposition and focus on discussing with clients how your platform can be integrated across the HR Technology stack. Every dollar needs to be directed to build stronger relationships with clients and/or product improvements.

For HR functions, the HR Tech budget will be limited, and dollars will need to be used wisely to develop an integrated HR technology stack to enable work, workforce, and workplace. This includes, defining the HR technology architecture outlining your systems of record, systems of intelligence, systems of experience and use cases for enablement.

Highlights:

Relevant Acquisitions in 2022

Payroll

Recruiting

People Analytics

Learning/Upskilling

HCM

Process Mining

Employee Listening

More to come! Stay tuned.

Note: All views expressed in this article do not represent the opinions of any entity whatsoever with which I have been, am now, or will be affiliated. My opinions are my own.

Share it with your network:

Albert brings global market research experience to help executives harness intelligent technologies, reinvent HR, re-skilling and employee experience across NAR, APAC, LATAM and EMEA regions.

Hello, and welcome back to my Blog! This is a question that I get all

The Challenge: A Ieading banking organization, with over 200,000 employees, embarked on a strategic investment

The Challenge: A leading global consumer organization, with over 40,000 employees, was navigating through the

The Challenge: One the largest pharma organization, with 130,000 employees, was looking to transform the